You will find that do – it yourself tax planning is both rewarding and challenging. You will be able to choose the tax saving instrument that meets your needs. However, if you make the wrong choice you will have to live with an inappropriate investment for at least 3 – 5years.

An annual ranking of the best tax – saving options can help you decide but you will need to consider if the top rating tax saving investments are right for you. Getting professional help may be the best course to take. One choice you will need to make is whether to invest in long – term options or short – term investment plans.

Table of Contents

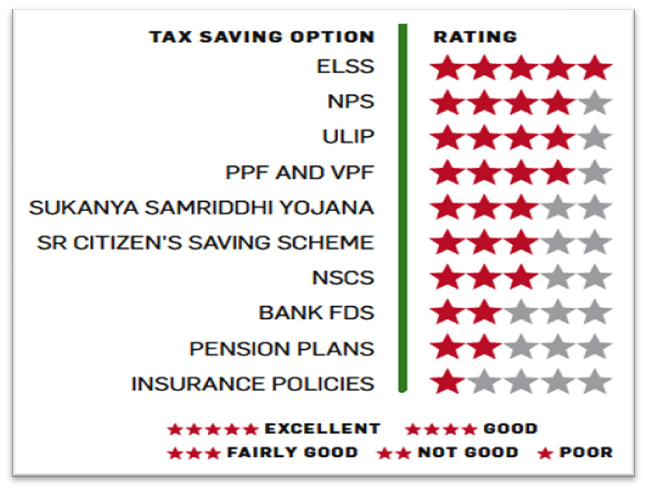

The Economic Times Wealth Ratings.

The annual ranking of best tax – saving plans measures all the investment options with 7 key measures:

Flexibility.

Returns.

Liquidity.

Costs.

Safety.

Transparency.

Taxability of Income.

Each measure is given equal weight and a composite score is worked out for the different tax – saving options.

Rankings can assess all investment plans on their performance. However, don’t go by ranking alone. Some plans may not be appropriate for certain investors. Senior Citizens over 70 should avoid the ELSS which offers great returns. The Senior Citizen’s Saving Scheme, the Public Provident Fund or tax – saving fixed deposits are better options for them. They are safe and secure even though they are ranked lower. Some investors may not be able to avail of all investment options.

Short Term Investment Plans Versus Long-Term Plans

Short Term Investment Plans – These are sold after 3 years or less. Examples of short – term investment plans are mutual funds, bond mutual funds, stocks and some bonds. It is difficult to get higher returns than the average stock market rate (about 7%) by trading short term.

Long Term Investment Plans – They pay over several years. The plans are more suitable for investors saving for a long – term goal such as retirement or a college fund. If you plan to sell in 3 years or have a short – term goal like a vacation do not invest your money in these plans.

Short – Term Investment Plans and Long – Term Plans Distinctions.

Different Expectations – If you intend to keep the investment for many years you will probably expect it to increase in value. You will then be able to sell it and make a profit. Also, you want it to provide income. You would expect short – term investment plans to protect the principal and not increase in value to any extent.

Different Needs – You would choose short term investment plans for a down payment on a loan. A long – term need would be retirement capital. As you get older there is less need for long – term vehicles as short – term investment plans fulfil your needs.

Different Risks – All investments come with some risks. Volatilityis one of the greatest risks with long – term investments. Investments will lose value due to the fluctuating financial markets. Short – term investment plans may be exposed to purchasing – power risks. Your investment return may not keep up with inflation.

You may decide that both short and long – term investments are a good option for you.

Insurance Agents – You Can Get Help.

Insurance planners can make the investment process very easy. They will help you work out your risk tolerance and financial goals. They will also help you create a portfolio that fits these factors. Your financial goals will help you and the financial planner work out the best way to go. You will then just have to sign on the dotted line.

The Future of Investment Advice.

There are 62 million residences with annual incomes over Rs500,000 in India. However, there are only 2,500 financial planners to assist them. You will also pay a high cost for their help. Traditional planners charge between 1 & 2 percent of your assets each year to manage your money.

Robo advisors or online advisors are on track to play a big part in your financial future. They will provide a personalised automated plan, choose the right funds to add to your portfolio and screen your investments at a fraction of the cost of a human planner.

A good robo – advisor:

· Charges a one – off fee.

· Is not impeded by human biases and prejudices.

· Gives advice based on meticulous research and empirical data.

Robo advisors are still unexplored territory but in future years they will win the trust of wary investors.

Choosing a long term or short – term investment plans is not always easy. You may realise you do not want to go it alone and need professional help. After investigating the best plans in the market, you will need to decide which plan is best for your goals. The right choice will set you up for life.