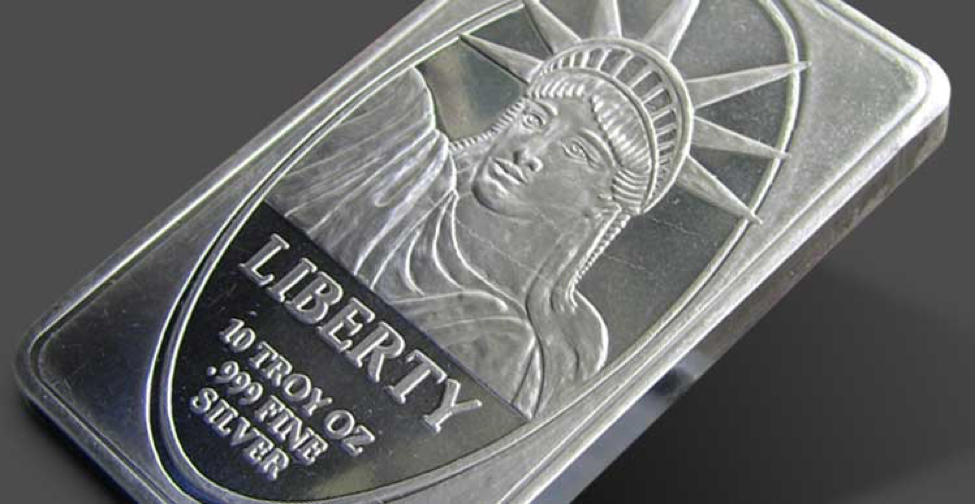

Diversification is imperative for investments and any expert will tell you that the old adage is true: you don’t want to put all your eggs in one basket. Silver and gold bullion are great inflation-proof ways to invest and they are a surefire diversification tool. What is bullion? Bullion means a precious metal stamped in the shape of bars — and stands in as a physical representation of wealth. Quite frankly, when a person buys a bullion bar, it means that they are buying in bulk — after all a bar of gold weighs 12.4 kilograms. Forget the silver and gold coins that are nice to place on your mantle but don’t have as much value; bullion allows a serious investor to get massive quantities and store it easier. You will find that mining and refinery companies don’t utilize this term, but investors and bullion traders certainly do. It is used for gold, silver, copper, nickel and aluminum; all the base metals are made into bullion and consequently, it can also be used to refer a piece of metal that is shaped like a coin or bar and has been plated with one of the aforementioned precious metals. An example would be a gold-plated bar or coin.

How does bullion play such an integral role in the diversification process? To adequately evaluate the importance of diversifying, one must consider the doomsday scenario. Gold has the greatest value of all the precious metals, followed closely by silver. If the economy were to tank next year or even tomorrow, these metals can be used to directly pay for goods and services — unlike stocks, bank notes, or paper money, they retain their value because they are not merely metonyms for wealth, but rather they exist as physical wealth itself. Some predict the value of the dollar will plummet, and should this happen, gold and silver won’t lose their value. They are inflation-proof and resist devaluation due to market trends. In fact, according to Guildhall Wealth Management, a Canadian investment expert, gold and silver bullion often have an inverse relationship to the traditional market.

Remember the crash in 2008 that affected the overall financial market until 2013? The great thing for silver and gold collectors was that precious metals gained in the markets to the tune of 32 percent during this time. By diversifying your portfolio and getting your hands on some gold or silver, you are hedging against, inflation, devaluation, and market instability. While it doesn’t often get the attention that it should, silver is an affordable precious metal that is often undervalued, and experts tend to agree that it is a great alternative to gold. Both silver and gold have few counter-party risks; it doesn’t fall into someone else’s liability. The industrial world uses silver, making it a practical investment, as it has pragmatic uses outside of speculation. A wealth management company like Guildhall can help you explore your options and add gold or silver bullion to your portfolio in order to diversify and protect it. Visit Guildhallwealth.com to learn more about diversifying your portfolio with investment strategies for gold and silver.

The thing to keep in mind is that during times of crisis, metals keep their value, and more often than not they increase in value. With instability and hyperinflation affecting world markets, who knows how important that gold bullion will be in the troublesome months ahead?